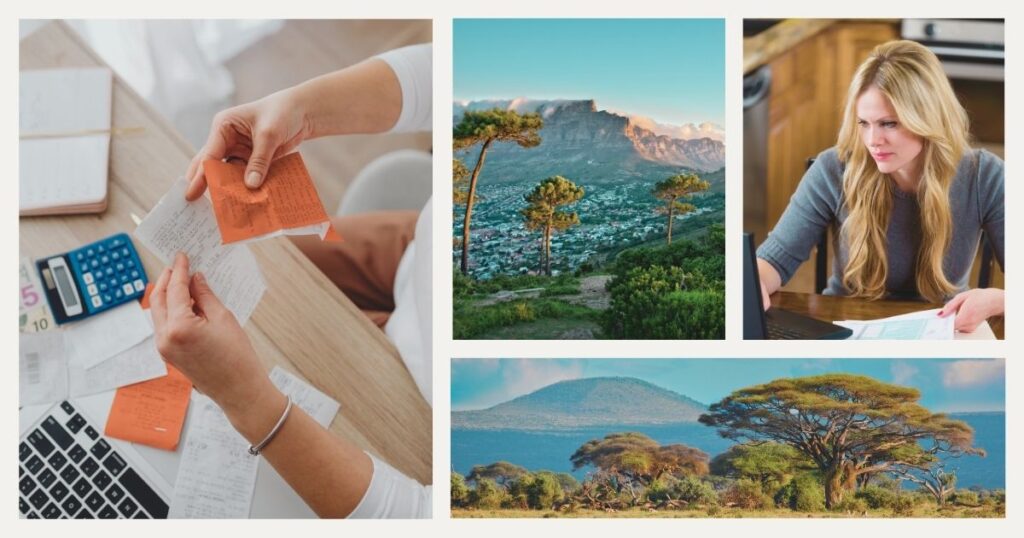

Navigating taxes in South Africa as an expat can feel like decoding a complex puzzle, especially when you’re juggling life in a new country with obligations back home. Whether you’re a digital nomad working from Cape Town’s trendy cafés or a long-term resident building a new life in Johannesburg, understanding your tax responsibilities is crucial for maintaining financial peace of mind.

South Africa’s tax system has unique characteristics that affect expats differently depending on their residency status, income sources, and length of stay abroad. This comprehensive guide will walk you through everything you need to know about taxes in South Africa as an expat, from determining your tax residency to maximizing legitimate deductions and staying compliant with both countries’ requirements.

Understanding South African tax residency status

Your tax obligations in South Africa largely depend on whether you’re classified as a resident or non-resident for tax purposes. This classification affects how much of your worldwide income is subject to South African taxation.

Determining your tax residency

South Africa uses two tests to determine tax residency: the ordinary residence test and the physical presence test. If you qualify under either test, you’re considered a South African tax resident and must declare your worldwide income.

The ordinary residence test considers where your permanent home is located. Even if you live abroad temporarily, you might still be considered an ordinary resident if South Africa remains your true home base. Factors include where your family lives, where your main assets are located, and your long-term intentions.

The physical presence test is more straightforward. You’re a resident if you’ve been physically present in South Africa for more than 91 days in the current tax year and more than 91 days in each of the five preceding tax years, with a total of more than 915 days during those five years.

💡 Did you know? Many expats mistakenly believe that simply leaving South Africa automatically changes their tax residency status. The process often requires formal steps and careful documentation.

Implications of tax residency

As a South African tax resident, you’re liable for taxes in South Africa on your worldwide income, regardless of where it’s earned. This includes salary, business income, investment returns, and rental income from any country.

Non-residents, however, only pay South African taxes on income sourced within South Africa. This might include rental income from South African properties, dividends from South African companies, or income from work performed in South Africa.

🌟 Pro tip: if you’re planning to become a non-resident, ensure you understand the formal process for changing your tax status. This often involves submitting specific forms to SARS and may require professional assistance.

Key tax obligations for South African expats

Understanding your specific tax obligations helps you stay compliant while potentially reducing your overall tax burden through legitimate planning strategies.

Filing requirements and deadlines

South African tax residents must file annual income tax returns, regardless of where they live. The tax year runs from March 1 to February 28, and filing deadlines vary depending on your submission method and whether you use a tax practitioner.

For individuals filing their own returns online, the deadline is typically October 31. If you use a registered tax practitioner, you generally have until January 31 of the following year. Non-residents must also file returns if they have South African-sourced income exceeding certain thresholds.

Even if you don’t owe any taxes in South Africa due to foreign tax credits or exemptions, you’re still required to file if you meet the filing criteria. Failure to file can result in penalties, even if no tax is ultimately due.

Double taxation agreements and relief

South Africa has double taxation agreements (DTAs) with many countries to prevent expats from being taxed twice on the same income. These agreements typically allow you to claim credit for taxes paid in your country of residence against your South African tax liability.

The foreign employment income exemption allows South African residents working abroad to exclude up to R1.25 million of foreign employment income from their South African tax calculation, provided they meet specific requirements. To qualify, you must be outside South Africa for more than 183 days during a 12-month period, with a continuous period of more than 60 days abroad.

💡 Did you know? The foreign employment income exemption doesn’t apply to all types of income. Investment income, rental income, and business profits may still be fully taxable in South Africa, even if earned abroad.

Digital nomad-specific tax considerations in South Africa

Digital nomads face unique challenges when dealing with taxes in South Africa, particularly around proving the source of income and maintaining proper documentation while constantly moving.

Income source and documentation

For digital nomads, determining the source of income can be complex. South African tax law generally considers income to be sourced where the services are rendered or where the income-producing activities take place. If you’re working remotely for a South African company while traveling, this income might still be considered South African-sourced.

Maintaining detailed records becomes crucial for nomads. Document your location during work periods, keep contracts and invoices organized, and track which services are performed where. This documentation supports your tax position and helps if SARS requests additional information.

Consider using digital tools to track your movements and work activities. GPS logs, travel bookings, and accommodation records can serve as supporting evidence for your tax calculations and exemption claims.

Managing technology and connectivity for tax compliance

Staying connected while managing your tax obligations requires reliable internet access, especially during filing season. Modern nomads need consistent connectivity to access South African Revenue Service (SARS) online systems, maintain digital records, and communicate with tax professionals back home.

Holafly’s international data plans ensure you maintain the connectivity needed to handle your tax obligations regardless of your location. Their flexible data solutions help nomads stay compliant with filing deadlines while exploring new destinations.

🌟 Pro tip: set up automatic reminders for important tax dates and ensure you have backup internet solutions during critical filing periods. Missing deadlines due to connectivity issues won’t excuse you from penalties.

Common tax planning strategies for expats

Strategic tax planning can help you minimize your overall tax burden while remaining fully compliant with both South African and foreign tax obligations.

Timing income and deductions

The timing of when you receive income or claim deductions can significantly impact your tax liability. If you’re transitioning between tax residency statuses, carefully consider when to realize gains, receive bonuses, or make deductible investments.

For expats who become non-residents, timing the disposal of assets before or after the change in status can have substantial tax implications. Capital gains tax rules differ for residents and non-residents, so professional advice is essential for significant transactions.

Consider spreading income across tax years when possible, especially if you’re subject to progressive tax rates. This strategy might help you stay in lower tax brackets and reduce your overall tax burden.

Retirement and investment planning

South African expats must carefully plan their retirement and investment strategies to optimize tax efficiency across multiple jurisdictions. Contributions to South African retirement funds might provide current deductions but could complicate future tax obligations.

Consider the tax treatment of different investment vehicles in both South Africa and your country of residence. Some investments that are tax-efficient in South Africa might be heavily taxed abroad, and vice versa.

💡 Did you know? South African retirement funds have specific rules about preservation and withdrawal that can affect expats differently. Understanding these rules before making contributions or withdrawals is crucial for long-term tax planning.

Technology and digital infrastructure for tax management

Managing taxes in South Africa as an expat requires robust digital infrastructure and organizational systems that work across different time zones and countries.

Essential digital tools for tax compliance

Modern expats rely heavily on digital tools to manage their tax obligations efficiently. Cloud-based accounting software allows you to track income and expenses in real-time, regardless of your location. Popular options include systems that integrate with South African banking and can generate reports compatible with SARS requirements.

Document management systems become crucial for expats who need to maintain records across multiple years and jurisdictions. Scan and store important documents like tax certificates, bank statements, and employment contracts in organized, accessible formats.

Consider using time-tracking apps if your work spans multiple countries or if you need to prove where services were performed. These records support income source determinations and exemption claims.

Communication with tax professionals

Maintaining effective communication with South African tax professionals while living abroad requires planning and the right technology setup. Video conferencing, secure document sharing, and encrypted communication tools help you work effectively with advisors back home.

Time zone differences can complicate urgent tax matters, so establish clear communication protocols with your tax advisor. Agree on preferred communication methods, response timeframes, and emergency contact procedures for deadline-sensitive situations.

🌟 Pro tip: schedule regular check-ins with your tax advisor throughout the year, not just during filing season. Proactive planning often saves more money than reactive compliance.

Final thoughts

Understanding taxes in South Africa as an expat doesn’t have to be overwhelming when you have the right information and support systems in place. The key lies in determining your correct tax residency status, maintaining detailed records, and staying proactive about compliance requirements.

Whether you’re planning a temporary adventure abroad or making a permanent move, proper tax planning protects your financial future and ensures peace of mind. Remember that tax laws change regularly, and your personal situation may evolve, so staying informed and seeking professional advice when needed is always wise.

The investment in proper tax planning and compliance pays dividends in reduced stress, avoided penalties, and optimized financial outcomes across your global lifestyle.

Ready to navigate your expat tax journey with confidence? Whether you’re planning your move abroad or need help with current obligations, proper guidance makes all the difference.

For comprehensive support with your nomadic lifestyle, including financial management strategies for digital nomads, and practical solutions to complex challenges, visit Nomada and let us help simplify your international tax compliance 👉

Frequently asked questions about taxes in South Africa for expats

If you remain a South African tax resident, yes, you must continue filing annual returns regardless of where you live. However, if you’ve formally emigrated and become a non-resident, you only need to file if you have South African-sourced income above certain thresholds.

The exemption depends on where you physically perform the work, not who employs you. If you work outside South Africa for the required number of days, you may qualify for the exemption even while employed by a South African company.

Failing to inform SARS about residency changes can lead to continued tax obligations as a resident, potential penalties, and complications with future compliance. It’s essential to follow the proper procedures when changing your status.

Double taxation agreements prevent you from being taxed twice on the same income but don’t eliminate your filing obligations. You may still need to file returns in both countries and claim credits for taxes paid abroad.

Yes, South Africa generally allows credits for foreign taxes paid on the same income, subject to specific limitations and requirements. The credit is typically limited to the South African tax that would be payable on that income.