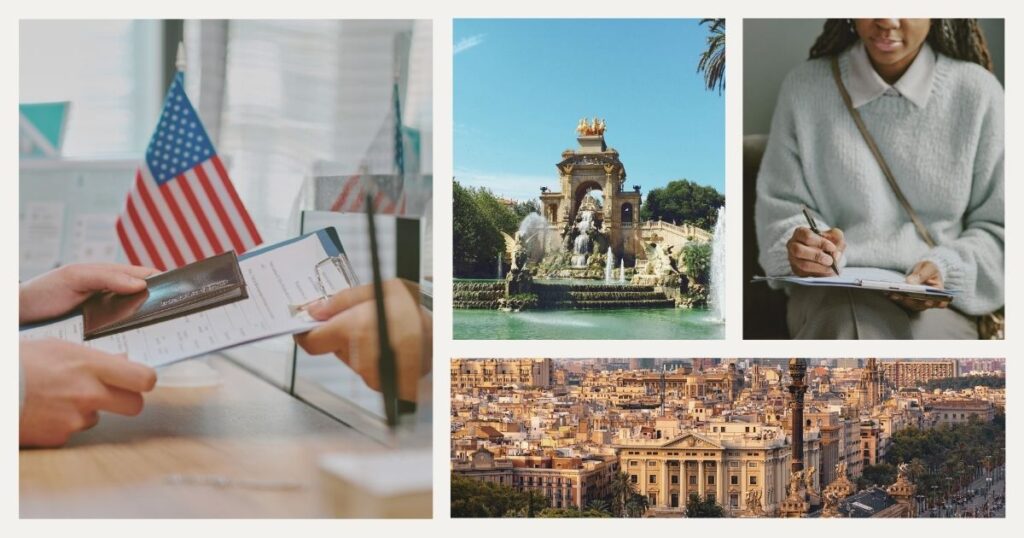

Barcelona captivates American digital nomads with its perfect blend of Mediterranean culture, vibrant startup scene, and exceptional quality of life. The prospect of living in Barcelona as an American presents exciting opportunities alongside unique challenges that require careful planning and cultural adaptation. From navigating Spanish bureaucracy to understanding tax obligations, American remote workers must prepare for significant lifestyle changes while embracing the rewards of European living.

This comprehensive guide addresses the practical, legal, and cultural aspects of establishing residence in Barcelona, helping American digital nomads make informed decisions about their Spanish adventure. Understanding visa requirements, tax implications, and daily life considerations ensures a smooth transition to living in Barcelona as an American while maintaining professional productivity and personal fulfillment.

Visa requirements and legal considerations

American citizens planning extended stays in Barcelona must navigate Spain’s immigration system, which offers several pathways for legal residence depending on circumstances, duration, and work arrangements.

Tourist vs. long-term visa options

Americans can visit Spain visa-free for up to 90 days within any 180-day period under the Schengen Agreement, making short-term stays straightforward. However, living in Barcelona as an American for extended periods requires proper visa authorization to avoid immigration violations.

Spain’s Digital Nomad Visa, launched in 2023, provides excellent opportunities for American remote workers. This permit allows up to five years of residence with significant tax benefits for qualifying professionals. The visa requires proof of remote employment, minimum income thresholds, and comprehensive health insurance coverage.

💡 Did you know? Spain’s Digital Nomad Visa includes access to the Beckham Law tax regime, potentially reducing tax burdens for American digital nomads compared to standard Spanish tax rates.

Alternative options include student visas, investor visas for entrepreneurs, or family reunification visas for those with Spanish connections. Each pathway involves specific requirements and processing times that affect long-term planning.

Documentation and application process

Preparing visa applications requires extensive documentation, including passport validity, criminal background checks, financial statements, and health insurance certificates. Americans must obtain these documents from U.S. authorities, and often require apostille certification for Spanish recognition.

The digital nomad visa application process typically takes 30-90 days, though processing times vary by consulate and application complexity. Americans can apply from U.S. consulates or directly in Spain, depending on specific circumstances.

🌟 Pro tip: start your visa application process at least 3-4 months before your planned departure. Document preparation, apostille certification, and consulate appointments often take longer than expected.

Legal experts specializing in Spanish immigration can streamline applications and ensure compliance with evolving requirements.

Tax obligations and financial planning

Living in Barcelona as an American involves complex tax considerations affecting both U.S. and Spanish obligations. Understanding these requirements prevents costly mistakes and optimizes financial planning for long-term residence.

U.S. tax obligations for expats

Americans remain subject to U.S. tax obligations regardless of their residence location, creating dual filing requirements for Barcelona residents. The Foreign Earned Income Exclusion allows excluding up to $120,000 of foreign earned income (2023 figures), though specific conditions apply.

Foreign Bank Account Reporting (FBAR) requirements mandate disclosure of foreign financial accounts exceeding $10,000 in aggregate value. Form 8938 requires reporting specified foreign financial assets above certain thresholds.

💡 Did you know? Americans living in Barcelona may qualify for Foreign Tax Credits, offsetting Spanish taxes against U.S. obligations. Proper planning can minimize overall tax burdens while maintaining compliance.

Tax preparation becomes significantly more complex for expatriate Americans, often requiring professional assistance familiar with international tax law.

Spanish tax residency and benefits

Spain considers individuals spending more than 183 days annually as tax residents, subjecting worldwide income to Spanish taxation. However, the Beckham Law provides alternative tax treatment for qualifying foreign residents, potentially reducing effective tax rates.

Digital nomad visa holders may access preferential tax treatment under updated regulations, though specific benefits depend on individual circumstances. Professional tax advice becomes essential for optimizing Spanish tax obligations while maintaining U.S. compliance.

Barcelona residents benefit from Spain’s social security system, including healthcare access and eventual pension rights.

Cultural adaptation and daily life

Living in Barcelona as an American requires significant cultural adjustments affecting everything from work schedules to social interactions. Understanding these differences enhances integration while avoiding common cultural misunderstandings.

Language and communication

While many Barcelona residents speak English, especially in international business contexts, learning Spanish and basic Catalan significantly improves daily life and cultural integration. Catalan serves as Barcelona’s co-official language alongside Spanish, appearing on street signs and official documents.

🌟 Pro tip: maintain seamless communication with family and work contacts using Holafly’s international eSIM solutions, providing reliable connectivity for video calls and messaging without expensive roaming charges throughout your Barcelona experience.

Language exchange programs, local meetups, and digital nomad communities provide opportunities to practice Spanish while building social networks. Professional situations often require Spanish fluency, particularly for banking, legal matters, and official procedures.

Work culture and business practices

Spanish work culture differs significantly from American norms, emphasizing work-life balance through longer lunch breaks, later dinner times, and extended August vacations. Many businesses close during siesta hours (2:00-5:00 PM), requiring schedule adjustments for meetings and errands.

Barcelona’s startup scene embraces international collaboration, though relationship-building remains crucial for business success. Spanish professional culture values personal connections and extended relationship development over purely transactional interactions.

Networking events, coworking spaces, and professional associations provide platforms for building business relationships while understanding local professional norms.

Housing and neighborhood selection

Finding suitable accommodation represents one of the most challenging aspects of living in Barcelona as an American, particularly given the competitive rental markets and complex lease agreements requiring local knowledge.

Rental market and housing types

Barcelona’s rental market experiences high demand and limited supply, particularly for quality accommodations in desirable neighborhoods. Americans should expect smaller living spaces compared to typical U.S. housing, though central locations compensate through walkability and public transport access.

Rental agreements typically require multiple deposits, guarantors, and extensive documentation. Many landlords prefer long-term tenants, though short-term furnished rentals cater to digital nomads and international professionals during transition periods.

Popular neighborhoods for American expats include Eixample for central convenience, Gràcia for bohemian charm, and Poblenou for tech industry proximity. Each area offers distinct advantages regarding transport connections, cultural amenities, and community characteristics.

Legal requirements and documentation

Rental contracts require understanding Spanish legal terminology and tenant rights, which differ significantly from U.S. rental laws. Professional assistance or bilingual real estate agents help navigate complex agreements and local regulations.

Most rental applications require proof of income, employment contracts, and bank statements. Americans may need additional documentation proving legal residence status and financial stability from U.S. sources.

💡 Did you know? Spanish rental law heavily favors tenants, providing strong protections against arbitrary eviction and rent increases. Understanding these rights helps Americans navigate landlord relationships and housing disputes effectively.

Utility setup, internet installation, and municipal registration (empadronamiento) require specific procedures and documentation. Building relationships with neighbors and local service providers facilitates smoother accommodation transitions.

Healthcare and insurance

Living in Barcelona as an American requires understanding Spain’s healthcare system and ensuring adequate medical coverage for both routine care and emergency situations.

Spanish healthcare system access

Spain’s public healthcare system (SNS) provides excellent medical care, though access depends on legal residence status and social security contributions. Digital nomad visa holders may access public healthcare through specific arrangements, though private insurance often proves more practical initially.

Private healthcare in Barcelona offers shorter wait times, English-speaking providers, and comprehensive coverage. Many international insurance plans provide coverage in Spain, though understanding policy limitations and network providers prevents unexpected costs.

American prescriptions may require Spanish medical approval or equivalent medication substitution. Bringing adequate supplies during initial transition periods ensures continuity of essential treatments while establishing local medical relationships.

Insurance requirements and options

Spanish visa applications typically require comprehensive health insurance meeting specific coverage minimums. International providers like Cigna, Allianz, or local Spanish companies offer policies designed for expatriate residents.

Emergency medical evacuation coverage becomes important for Americans maintaining ties to U.S. healthcare providers or specialists. Some conditions may require treatment in the U.S., making evacuation insurance a valuable safety net.

🌟 Pro tip: research Barcelona’s medical facilities and English-speaking providers before arrival. Hospital Clinic Barcelona and Hospital Sant Joan de Déu offer excellent care with international patient services for complex medical needs.

Dental and vision care often require separate coverage or direct payment, as Spanish public healthcare provides limited coverage for these services. Factor these costs into healthcare budgeting for comprehensive medical protection.

Banking and financial services

Establishing banking relationships represents a crucial step for Americans settling in Barcelona, affecting everything from rent payments to visa renewal documentation.

Opening Spanish bank accounts

Spanish banks typically require residence certificates (empadronamiento), work contracts, and extensive documentation for account opening. Americans may face additional scrutiny due to FATCA reporting requirements affecting international banking relationships.

Major Spanish banks like BBVA, Santander, and CaixaBank offer international services with English-speaking staff in Barcelona branches. Online banks like ING or digital solutions may provide easier account opening for technically savvy Americans.

Bank account ownership facilitates rent payments, utility bills, and official procedures requiring Spanish banking relationships. Many visa renewals and official processes require Spanish bank statements as proof of financial stability.

International money management

Currency exchange and international transfers require strategic planning to minimize fees and optimize exchange rates. Services like Wise (formerly TransferWise) or Remitly often provide better rates than traditional banking for U.S.-Spain transfers.

Maintaining U.S. banking relationships remains important for American tax obligations, investment management, and family financial connections. Notify U.S. banks about your international residence to prevent account restrictions or security holds.

💡 Did you know? Some U.S. investment accounts and financial services become unavailable to overseas residents due to regulatory compliance. Review account terms and consider alternatives before establishing a Barcelona residence.

Credit card usage in Barcelona varies by establishment, with many small businesses preferring cash payments. Americans should maintain both Spanish and U.S. payment options for maximum flexibility.

Living in Barcelona as an American opens doors to European culture, professional opportunities, and lifestyle experiences unavailable in the United States. While challenges exist around bureaucracy, language barriers, and cultural adaptation, proper preparation and realistic expectations ensure successful transitions. The city’s international community, excellent infrastructure, and vibrant culture create ideal conditions for American digital nomads seeking European adventures.

For comprehensive guidance on Spanish visa requirements and tax obligations specifically affecting American digital nomads, explore our detailed Spanish digital nomad visa guide covering all aspects of legal residence establishment.

Let Nomada support your journey toward successful nomadic life in Barcelona and beyond. 🌟

Frequently asked questions about living in Barcelona as an American

While many Barcelona residents speak English, especially in international business and tourist areas, learning Spanish significantly improves daily life quality. Catalan is also widely spoken locally. Basic Spanish proficiency helps with banking, healthcare, and official procedures, though many services cater to English speakers.

Living costs vary widely based on lifestyle and neighborhood choice. Budget €2,000-3,000 monthly for comfortable living, including rent, food, and entertainment. Rental costs consume 30-50% of budgets, with central neighborhoods commanding premium prices. Americans often find Barcelona more affordable than major U.S. cities.

Yes, but notify banks about your international residence to prevent account restrictions. Some investment services may become unavailable due to regulatory compliance. Maintain U.S. accounts for tax obligations and family connections while establishing Spanish banking for local needs.

Major differences include later meal times (lunch at 2-3 PM, dinner at 9-10 PM), extended lunch breaks, August vacation closures, and more relaxed business timelines. Spanish culture emphasizes relationships over efficiency, requiring patience and adaptation from Americans accustomed to faster-paced environments.

Barcelona generally costs less than major U.S. metropolitan areas like New York or San Francisco, though more than smaller American cities. Housing represents the largest expense, while food, transportation, and healthcare often cost significantly less than U.S. equivalents.